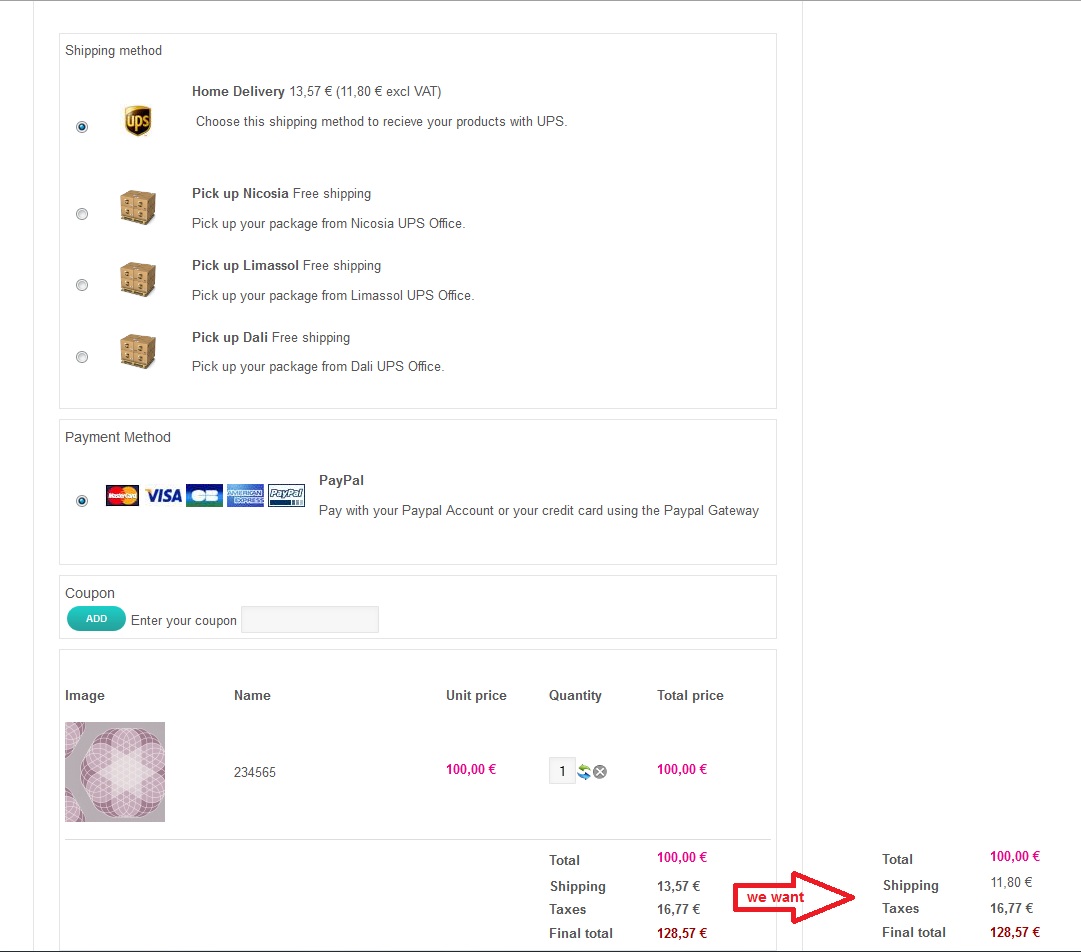

It's not a bug. It's just the way it is. In some places, have it with the VAT is mandatory, in some others, it's better without. So at one point we have to decide

In any cases, that can easily be changed by editing the file "cart" of the view "checkout" via the menu Display->Views and changing the lines:

if(bccomp($taxes,0,5)==0){

echo $this->currencyHelper->format(@$this->shipping->shipping_price,$this->shipping->shipping_currency_id);

}else{

echo $this->currencyHelper->format(@$this->shipping->shipping_price_with_tax,$this->shipping->shipping_currency_id);

}

to:

echo $this->currencyHelper->format(@$this->shipping->shipping_price,$this->shipping->shipping_currency_id);

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop