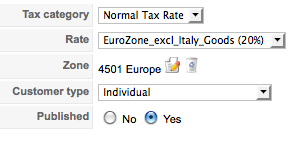

I'd like clarification that I have understood correctly in setting up the shop for VAT calculations, depending on the type of user and Eurozone country.

The shop is based in Italy, therefore I have to add VAT (Iva) to all sales within Italy and also to individuals and companies that do NOT have VAT numbers in other European countries.

I have set up two Tax Rules (config/system/taxes), as can be seen by the attachment, but do I need a third one for Company with VAT number?

When a user goes to the checkout and registers his/her address, they have the option to fill in the

company field and

VAT number field.

- If these two fields are NOT filled in by the user then they will have VAT added in the cart, in any Eurozone country including Italy.

- If they fill in the

company field but NOT the

VAT number field they too will have the VAT added to the total.

- If however they fill in both the

company field and

VAT number field then the VAT will NOT be added to the order.

Am I correct so far?

The reason I ask is that the following quote is taken from another thread which seems to be saying the opposite about companies with or without VAT.

"The individual will be considered as a company with VAT if he fills the company field. If he fills the VAT number field, he will be considered as a company without VAT."

Additionally I have activated the

VAT number check in Config/Main set to

check format.

If the address of the user is Germany (for example) and the number they enter is NOT valid does it give an error message to the user or merely ignore it and treat the order as an individual and add the VAT to the order?

And what happens when someone fills in the VAT number bit NOT the Company number? Does it take their name as the compny name? I have these two form fields set to NOT regquired as not all customers will be companies.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKASHOP ESSENTIAL 60€The basic version. With the main features for a little shop.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKAMARKETAdd-on Create a multivendor platform. Enable many vendors on your website.

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

HIKASERIALAdd-on Sale e-tickets, vouchers, gift certificates, serial numbers and more!

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop

MARKETPLACEPlugins, modules and other kinds of integrations for HikaShop